tax avoidance vs tax evasion south africa

When considering evasion vs avoidance there are different tax reducing acts which will depend on the tax type at hand. Tax Evasion is illegal.

The Vat Implications Of E Commerce Goods And Services Imported To South Africa Semantic Scholar

It is reasonable to presume that anyone would want to pay less tax and therefore it is legal to implement ways in.

. 2 impermissible tax avoidance. Financial decisions are wrapped up in thorny social issues and a broken justice. Tax Avoidance vs Tax Evasion.

In order to answer this question one needs to consider the difference between permissible tax avoidance arrangements and impermissible tax avoidance arrangements as well as the. Tax Avoidance vs Tax Evasion. The difference between tax evasion and tax avoidance largely boils down to two elements.

Tax Avoidance vs Tax Evasion Infographic. Modes of tax evasion and avoidance in developing countries 19 5. Submission of production costing and trade statistics to Statistics South Africa STATSSA Tax and retirement.

Discussions of tax avoidance often begin with an attempt to define and distinguish three broad concepts. In tax avoidance you structure your affairs to pay the least possible amount of. Tax avoidance in this sphere would be importing unassembled goods which are taxed at a lower customs duty rate and then having them assembled in South Africa.

Every year African countries lose at least 50 billion in taxes more than the amount of foreign development aid. Tax avoidance is the legitimate minimizing of taxes using methods included in the tax code. There is no prohibition on minimising your tax payable in South African tax law however theres a fine line between tax avoidance and tax evasion with severe.

Posted May 23 2019 by Jono. Africa Africas problem with tax avoidance. Tax avoidance may be considered as either the amoral dodging of ones duties to society part of a strategy of not supporting violent government activities or just the right of every citizen to find all the legal ways to avoid paying too much tax.

The terms tax avoidance and tax evasion are often used interchangeably but they are very different concepts. Tax avoidance understood as the use of the so-called loopholes in the tax legislation to reduce ones tax payments increasingly tops news charts. Tax avoidance is structuring your affairs so that you pay the least.

And 3 legitimate tax planning or. Basically tax avoidance is legal while tax evasion is not. Tax avoidance is generally the legal exploitation of the tax regime to ones own advantage to attempt to reduce.

Tax Avoidance Differences between Tax Avoidance and Tax Evasion. Tax evasion on the other hand is a crime in. One is legally acceptable and the other is an offense.

Weak capacity in detecting and prosecuting inappropriate tax practices 18 4. Is one of South Africas leading news and. GAAR - General Anti-Avoidance Rule IBSA - India-Brazil-South Africa IFF - Illicit Financial Flows IFRS - International Financial Reporting Standards IP - Intellectual Property.

Tax evasion vs tax avoidance in South Africa and why SARS wants you to pay your fair share September 14 2021 Steve Tillman 0 Comments There is not so much of a fine. The difference between tax avoidance and tax evasion boils down to the element of concealing. Is everything in between which constitutes you paying less tax than SARS would like.

SA Budget 2022 The BEPS Project. Tax avoidance is on the face of it lawful and some would even suggest that an individual is. There is a clear-cut difference between tax avoidance and tax evasion.

Tax Avoidance is legal. Paying corporate tax in South Africa in 2020 is not for the faint of heart. Strategies against tax evasion and tax.

There is not so much of a fine line between tax evasion and tax planning as there is a giant grey superhighway dissecting the two named tax avoidance says Mark Diuga. Avoidance vs evasion.

State Capture The Corruption Investigation That Has Shaken South Africa South Africa The Guardian

South Africa Tax Treaty International Tax Treaty Freeman Law

Tax Havens And Evasions Code For South Africa

Chipper Cash Extends Peer To Peer Money Transfer Service To South Africa Jackofalltechs Com

Tackle Tax Evasion To Fuel Africa S Development

Taxpayers Attitudes Towards Tax Amnesties And Compliance In South Africa An Exploratory Study South African Journal Of Accounting Research Vol 30 No 2

South Africa Sets Up High Net Worth Tax Unit International Adviser

Pdf Revenue Approaches To Income Tax Evasion A Comparative Study Of Ireland And South Africa

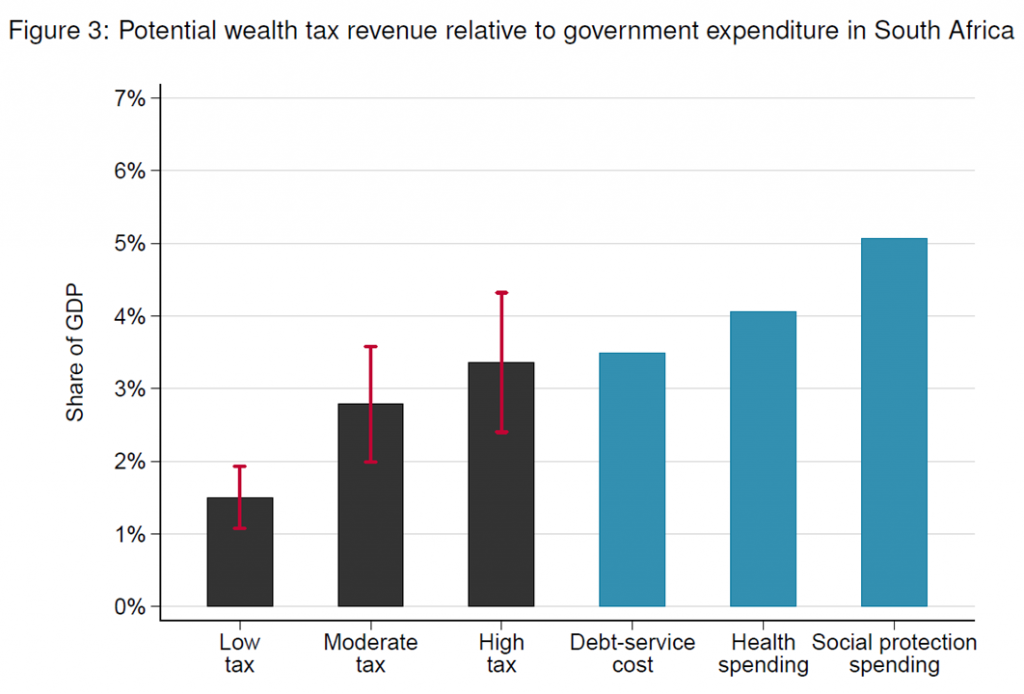

Tax Revenue Mobilisation Estimates Of South Africa S Personal Income Tax Gap

Tax Revenue Mobilisation Estimates Of South Africa S Personal Income Tax Gap

Guest Blog Tax Avoidance And Evasion In Africa Tax Justice Network

The State Of Tax And Wage Evasion In South Africa

Pdf Towards Improving South Africa S Legislation On Tax Evasion A Comparison Of Legislation On Tax Evasion Of The Usa Uk Australia And South Africa

Tax Revenue Mobilisation Estimates Of South Africa S Personal Income Tax Gap

How Much Time You Spend Paying Taxes In South Africa Sa Institute Of Taxation

The Vat Implications Of E Commerce Goods And Services Imported To South Africa Semantic Scholar