portland oregon sales tax 2019

Tax rates last updated in January 2022. Portland Tourism Improvement District Sp.

In The News Portland Commercial Real Estate Oregon Office Of Economic Analysis

For tax years beginning on or after January 1 2019 the Clean Energy Surcharge CES is a 1 surcharge on Retail Sales within the City of Portland imposed on Large Retailers.

. Business Tax Administrative Rule 50019-1 Clean Energy Surcharge CES - Utility. Corporations exempt from the Oregon Corporation Excise Tax. On February 21 2019 the Portland City Council passed Ordinance 189389 and Ordinance 189390 implementing the CES in.

The 925 sales tax rate in Portland consists of 7 Tennessee state sales tax and 225 Sumner County sales tax. For example under the South Dakota law a company must collect sales tax for online retail sales if. Fast Easy Tax Solutions.

60 for MBA members 95 non-members. Honolulu Hawaii has a low rate of 45 percent and several other major cities including Richmond Virginia keep overall rates modest. Valley region of the Pacific Northwest at the confluence of the Willamette and Columbia rivers in Northwestern Oregon.

Neither Anchorage Alaska nor Portland Oregon impose any state or local sales taxes. You can print a 725 sales tax table here. 425 max to sell a home in Salem and Bend.

The company conducted more than 200 transactions to South Dakota. The Oregon state sales tax rate is 0 and the average OR sales tax after local surtaxes is 0. Many other states are formalizing guidance through laws and regulations regarding collecting sales tax on online sales.

OR Sales Tax Rate. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. Oregon is one of five states with no statewide sales tax but Oregon law still allows municipalities or cities to enact their own local sales taxes at their discretion.

There are no local taxes beyond the state rate. Portland OR Sales Tax Rate. Wayfair Inc affect Oregon.

100 Working Portland sales tax calculator Updated 2021 and providing the best and accurate results you can get non other than on 360 taxes. The Portland Oregon sales tax is NA the same as the Oregon state sales tax. The Portland sales tax rate is.

Sales tax region name. Josh Lehner a senior economist with the Oregon Office of Economic Analysis compared the citys clean energy tax to Measure 97 a state business tax initiative that went before voters in 2016. Oregon is one of 5 states that does not impose any sales tax on purchases made in the state the others being Alaska Delaware Montana and New Hampshire.

The North Dakota sales tax rate is currently 5. There is no applicable city tax or special tax. Business Tax Administrative Rule 50019-2.

City of Portland Revenue Bureau. There are six additional tax districts that apply to some areas geographically within Portland. Oregon has no state sales tax and allows local governments to collect a local option sales tax of up to NAThere are a total of 55 local tax jurisdictions across the state collecting an average local tax of NA.

Real property tax on median home. The minimum combined 2022 sales tax rate for Portland North Dakota is 7. State and Local Sales Tax Rates Midyear 2019 Tax Foundation July 10 2019.

Method to calculate Portland sales tax in 2021. For tax rates in other cities see Ohio sales taxes by city and county. 2019 the Clean Energy Surcharge CES is imposed on businesses that have at least 500000 in Portland gross income and 1 billion in total gross income.

The 725 sales tax rate in Portland consists of 575 Ohio state sales tax and 15 Meigs County sales tax. The tax applies to revenue from all retail sales of property and services not specifically exempted. Ad Find Out Sales Tax Rates For Free.

The New Oregon and Portland Taxes on Gross Receipts. What is the sales tax rate in Portland Oregon. As of 2019 Portland had an estimated population of 654741 making it the 26th.

Filing Requirements All businesses that report total gross income of 1 billion or more and Portland gross income of 500000 or more on their Combined Business Tax. The cities and counties in Oregon do not impose any sales tax either. Click here for a larger sales tax map or here for a sales tax table.

The Oregon sales tax rate is currently. The minimum combined 2022 sales tax rate for Portland Oregon is. Sales Tax State Local Sales Tax on Food.

The Portland sales tax rate is 2. Over 2000 homes sold. While many other states allow counties and other localities to collect a local option sales tax Oregon does not permit local sales taxes to be collected.

The state sales tax rate in Oregon is 0000. There is no applicable city tax or special tax. The tax will apply to tax years beginning on or after January 1 2019.

Ashland for example has a 5 local sales. Information about Portland Business License Tax Multnomah County Business Income Tax and Metro Supportive Housing Services. Exact tax amount may vary for different items.

2019 the Clean Energy Surcharge CES is imposed on businesses that have at least 500000 in Portland gross income and 1 billion in total gross income. The state sales tax rate in Oregon is 0000. Portland collects the maximum legal local sales tax The 825 sales tax rate in Portland consists of 625 Texas state sales tax and 2 Portland tax.

The County sales tax rate is 0. This is the total of state county and city sales tax rates. 2022 Oregon state sales tax.

This is the total of state county and city sales tax rates. Combined with the state sales tax the highest sales tax rate in Oregon is NA in the cities of Portland. The current total local sales tax rate in Portland OR is 0000.

The companys gross sales exceed 100000 or. The sales tax jurisdiction name is Portland Sumner which may refer to a local government division. You can print a.

Did South Dakota v. Oregon Sales Taxes. The County sales tax rate is.

CES imposes a 1 surcharge on the retail sales within Portland of certain large retailers. Did South Dakota v. On November 6 2018 Portland voters passed Measure 26-201 which imposes a 1 gross receipts tax on large retailers.

Doug Fir Lounge Cool Kids Kids Drink Specials

81st Annual Nhrma Conference Tradeshow Northwest Human Resource Management Association

How Tax Evasion Fuels Traffic Congestion In Portland City Observatory

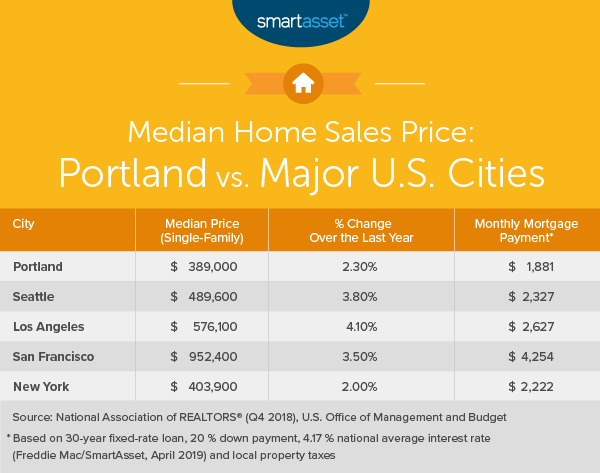

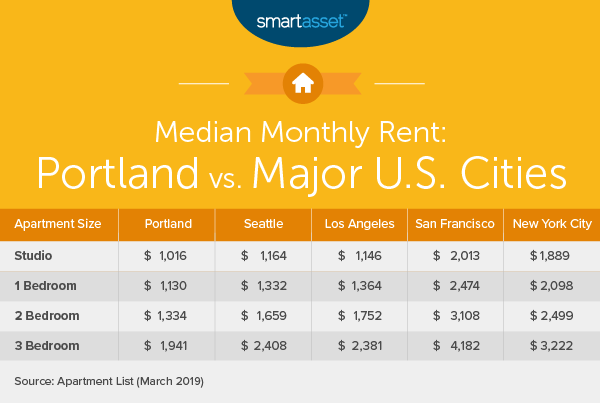

Cost Of Living In Portland Oregon Smartasset

Since 2010 Portland Or Has Grown By 8 Here Are Five Reasons Why So Many People Are Relocating There Moving To Portland North American Van Lines

Navigate Portland S Gross Receipts Tax On Large Retailers

Badb Catha Supersonicart Lily Seika Jones Songs Of Or At Animal Art Fairytale Art Art

What Living In Portland Is Like Is Moving To Portland A Good Idea

Oregon State 2022 Taxes Forbes Advisor

![]()

More Companies Moving To Portland In 2019 All Service Moving

Navigating New Sales Tax Rules In The Era Of Online Shopping Marketplace

10 Worst Neighborhoods To Live In Portland Oregon Living In Portland Oregon

Portland Oregon Learn About Life In And Around Portland Or Usa Pela

Cost Of Living In Portland Oregon Smartasset

Pin By Katie Sharon On Pacific Northwest Trip Rental Quotes Rv Quotes Cruise America

A Better Reality For Oregonians Requires Flipping The Tax System Oregon Center For Public Policy

Oregon Economic And Revenue Forecast December 2019 Oregon Office Of Economic Analysis Economic Analysis Oregon Forecast

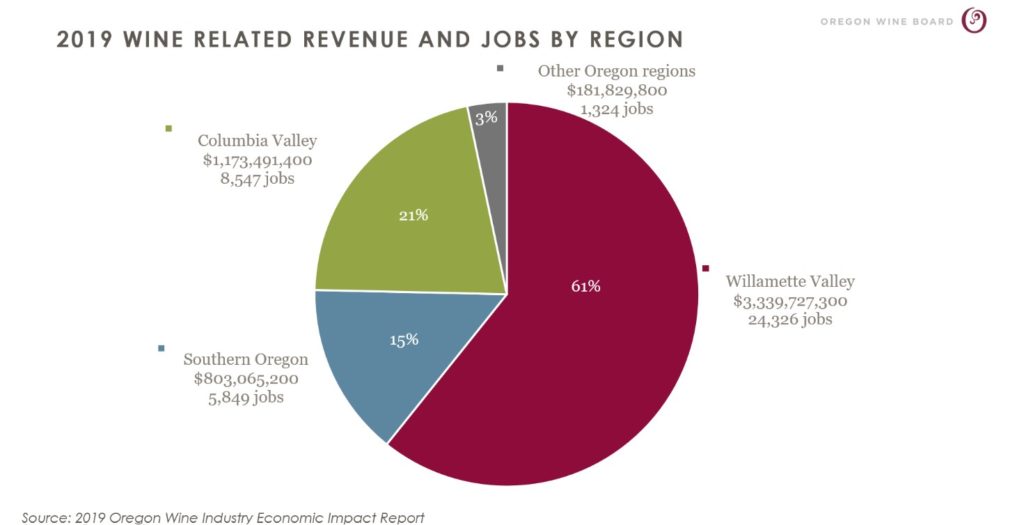

Oregon Wine Industry Continued On Its Long Term Growth Trajectory In 2019 But Encountered Headwinds In 2020 Oregon Wine Industry